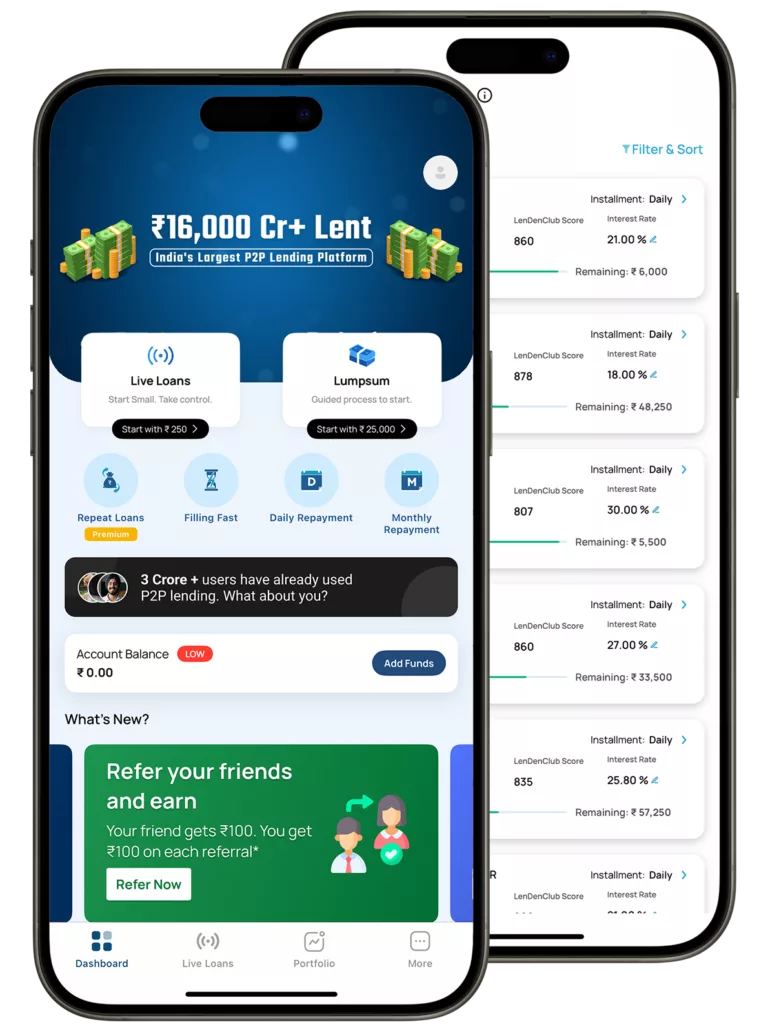

Lend Money on LenDenClub

India’s Trusted P2P Lending Platform

Lenders at LenDenClub have historically earned average interest* of 24% p.a.

Don’t miss the opportunity to diversify your portfolio with India’s largest peer to peer lending platform. Start earning daily or monthly repayments from verified creditworthy borrowers.

★★★★½

Highly Rated

NBFC-P2P

RBI Registered

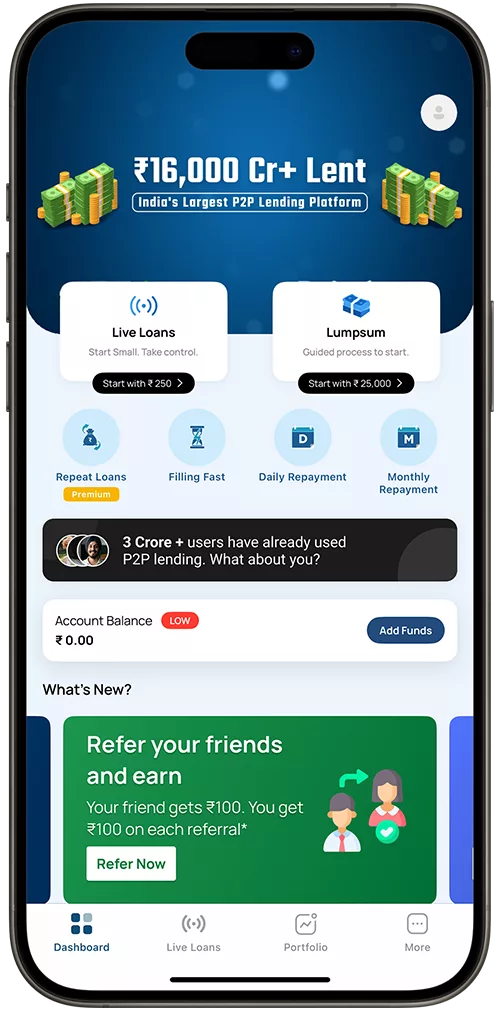

₹ 16,000 Cr+

Lent So Far

3 Crore+

Registered Users

Lend Smarter, Spread the Risk

Lend Smarter, Spread the Risk

Why Join The Largest P2P Lending Platform In India?

Earn Daily / Monthly Interest

Now, you can choose to fund loans with daily or monthly repayment options.

Choose How You Lend

Start small and take control with Manual Lending, or get started quickly with our guided Lumpsum Lending process.

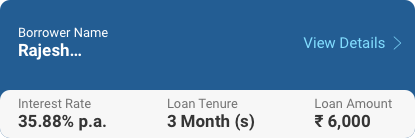

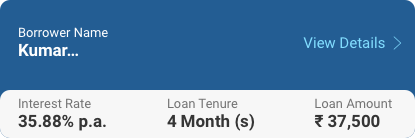

Repeat Borrowers

Our returning borrowers have a proven history of on-time repayments, helping you lend with greater confidence.

Portfolio Diversification

Think beyond the traditional market-linked instruments

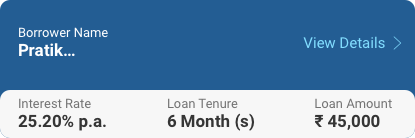

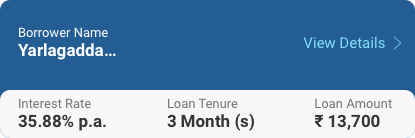

Earn Interest

Grow your wealth by earning interest from borrowers.

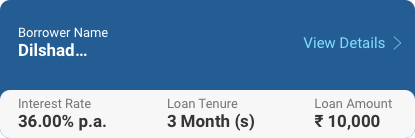

Verified Borrowers

Every borrower is carefully screened using over 670+ parameters.

Minimum Lending Amount

Start your lending journey with as low as ₹10,000 across dozens of borrowers.

Collection Support

You get support from our collection and recovery teams in case of delayed repayments.

What is P2P lending?

Peer to Peer or P2P lending in India is an alternative financing model that connects individual borrowers and lenders, bypassing traditional financial institutions. Originating in 2012, this form of lending has gained momentum globally and notably in India, where it gained legal recognition in 2018 through guidelines from the Reserve Bank of India. Expected to grow at a CAGR of 21.6% to reach USD 10 billion by 2026, P2P platforms offer various loan types, such as personal, business, and medical loans. Borrowers apply online, undergoing a KYC process and credit assessment. Lenders can then choose which loans to fund based on risk and simple interest profiles. Despite its growth and role in financial inclusion, the industry faces challenges like default and fraud risks. You can learn more about it in this detailed article about peer to peer lending in India.

Why settle for less when you can earn better interest with us?

Core values of the platform that deliver great results

100% Digital Process

Fund Diversification

No Withdrawal Fee

There is no charge for the withdrawal of your funds. You can get your funds in your bank a/c within 24 hrs of placing a request post maturity.

Zero Opening Fee

Opening an account on the platform costs you nothing. Open your P2P lending account at zero cost in less than a few minutes.

It is easier to start lending. Follow these three steps to get started.

Sign up using mobile number

Complete your KYC

Start Lending

Ready to start diversifying your funds?

Diversify your portfolio with LenDenClub and earn attractive interest by lending money in loans.

What our lenders ask?

Frequently Asked Questions (FAQs)

LenDenClub, a Peer to Peer Lending platform puts its best efforts into sourcing the right borrowers, and do thorough underwriting, information verification, and KYC checks. However, there is still a possibility of credit default risk for the borrower. It’s part and parcel of any lending activity. Here, your money is lent into loans. In a way, it’s a lending activity. Though LenDenClub’s platform’s performance is good, and it delivered good results in the past, it is vital for you to understand the risk involved in the lending. To mitigate this risk, your lent amount should be divided into small amounts. On the LenDenClub platform, the capital matching algorithm helps you achieve the same.

At LenDenClub, we take pride in operating fully within India’s legal framework. Peer-to-peer lending is legal in India when conducted through RBI-approved platforms like ours. We prioritize transparency, security, and compliance to ensure every transaction you make with us is safe, reliable, and compliant with all regulations. With LenDenClub, you’re choosing a trusted partner for hassle-free and legal P2P lending.

As the name suggests, P2P lending (peer-to-peer lending) is a concept in which individuals or institutes can lend money to borrowers. The system removes the role of a financial institution as an intermediary. Instead, P2P lending platforms act as facilitators for the transaction of money.

Anyone can become a lender on P2P lending platforms and effectively lend to many individuals or businesses from their homes. This mode of lending and borrowing has increased its adoption as an alternate way of financing.

Yes, LenDenClub is a fully regulated P2P lending platform, registered with the Reserve Bank of India (RBI) as an NBFC-P2P. All operations and processes follow RBI guidelines to ensure safety and transparency for both lenders.

Every borrower goes through a strict verification process, including KYC, income checks, credit bureau reports, and digital profiling. Only borrowers who meet LenDenClub’s eligibility and risk criteria are allowed to list loan requests on the India’s best P2P platform. As a platform we verify 600+ data points before approving a loan.

LenDenClub has multiple measures in place to recover pending dues from borrowers. These include auto-debit mandates and digital reminders. In addition, we have an in-house team of certified collection agents who operate in accordance with RBI guidelines, as well as partnerships with third-party recovery agencies.

Despite these rigorous efforts, there may be instances where a borrower fails to repay. To reduce the impact of such cases, we recommend diversifying your funds across multiple borrowers. This strategy helps improve portfolio performance and reduces individual risk exposure.