Diversify your portfolio with Lumpsum

Why lend small, when you can lend it all…

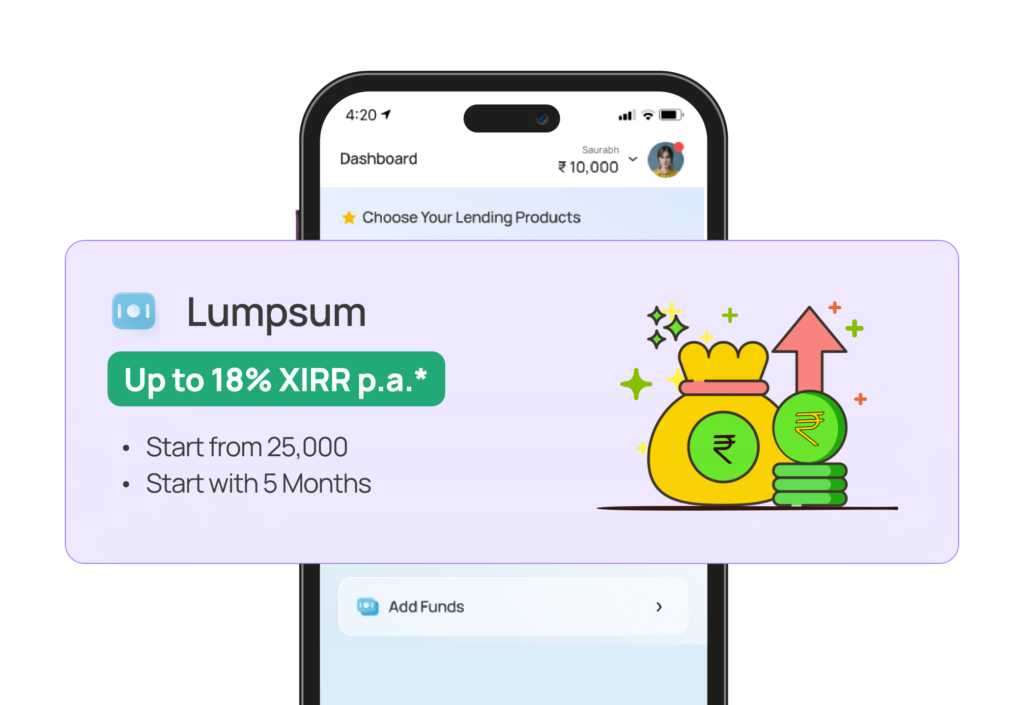

Lumpsum lending allows you to lend amounts ranging from ₹ 25,000 to ₹ 25,00,000 in one go. You can quickly diversify your funds across multiple loans, providing balanced risk and regular interest earned over 5 to 14 months.

Why lend small, when you can lend it all…

Lumpsum lending allows you to lend amounts ranging from ₹ 25,000 to ₹ 25,00,000 in one go. You can quickly diversify your funds across multiple loans, providing balanced risk and regular interest earned over 5 to 14 months.

- Start lending from ₹ 25,000

- Get repayment as soon as borrower pays

- 12% to 18% XIRR earned historically

- Start lending from ₹ 25,000

- Get repayment as soon as borrower pays

- 12% to 18% XIRR earned historically

What is Lumpsum?

With Lumpsum lending, you can distribute the entire sum across multiple loans of your choice in one go. Choose your criteria of lending, go through loans and lend starting from ₹25,000 up to ₹25,00,000 and diversify easily.

Maintain Cash Flow

Enjoy consistent cash flow with regular repayments. Lenders historically earned an XIRR of 12-18%.

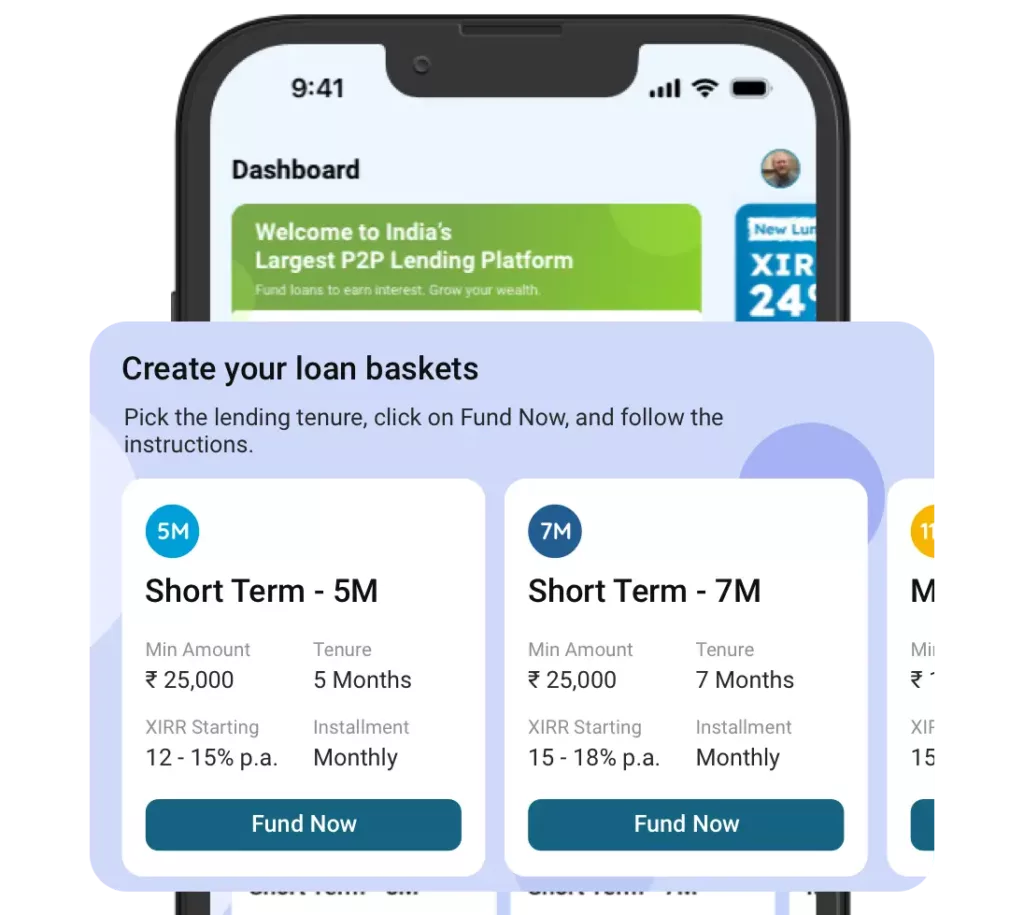

Short Tenure Lending

Now you can start your P2P lending journey with 5 and 14-month lending options.

Lend Big in One Go

Maximise your wealth by lending from ₹25,000 to ₹25,00,000 in a single transaction.

Whether you prefer daily or monthly repayments, Lumpsum allows you to earn a steady income flow on your lending.

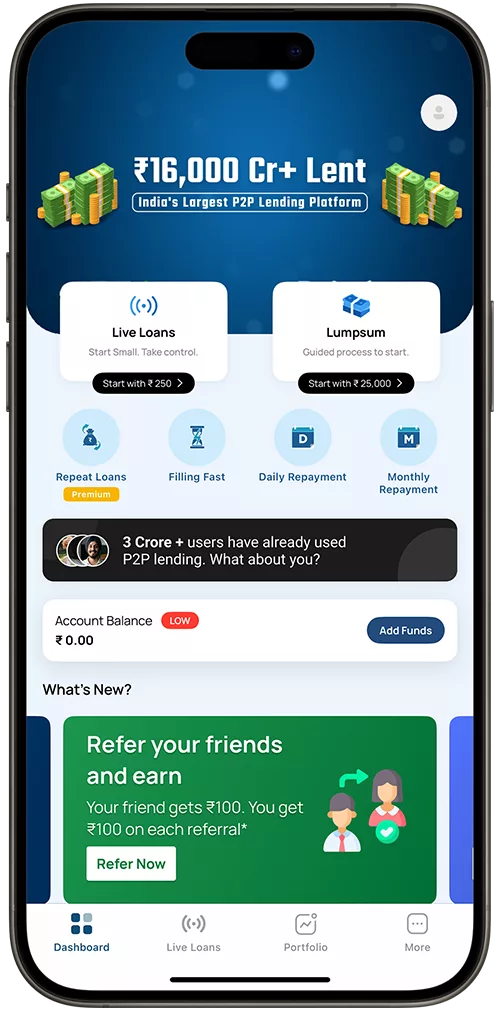

How to start lending in Lumpsum?

Step 1: Login to your LenDenClub account

Step 2: Go to the dashboard and click on the “Lumpsum” tab

Step 3: Enter your Lending amount and select a tenure

Step 4: Now make the payment using net banking, debit card or UPI

Step 5: Select your criteria to lend

Step 6: Review the list of loans as per your criteria and confirm.

That’s it. Your Lumpsum lending is now successful.

Frequently Asked Questions

Our lenders have a history of earning 12% – 18% XIRR.

Lumpsum is a lending option that allows you to lend large amounts, starting from ₹25,000 up to ₹25,00,000, in one go.

The lending period for Lumpsum ranges from 5 to 14 months, making it a short-term option for lenders seeking quicker interest.

You will receive regular repayments from loans you’ve funded through EDI (Equated Daily Installments) and EMI (Equated Monthly Installments).

Lumpsum simplifies your lending process by allowing you to lend a larger amount at once, allowing you to diversif across multiple loans and ensuring quicker interest with minimal effort.