What is the Escrow Mechanism in P2P Lending?

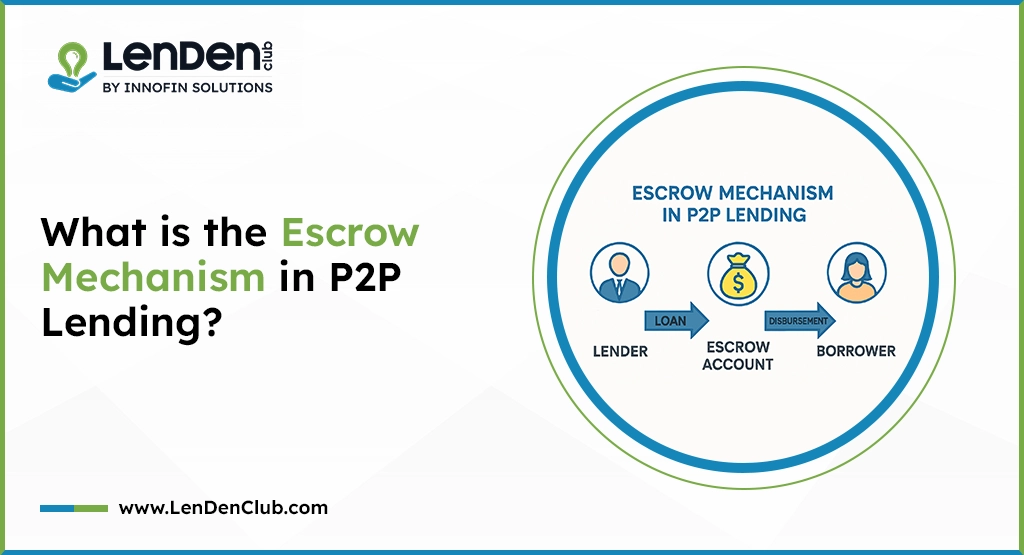

If you have ever looked into P2P lending, you probably wondered: How does the money actually move? And more importantly, what makes the whole process safe for everyone? That’s where the escrow mechanism comes in.

Let’s get into details –

What Is an Escrow Account in P2P Lending?

An escrow account is like a digital lockbox where money waits until the right conditions are met. In P2P lending, the escrow doesn’t belong to the platform, lender, or borrower. Instead, a neutral third party, usually a bank-appointed trustee, holds and releases funds based on instructions from the platform.

Key points:

- Neither lenders nor platforms can pull out funds for anything other than approved loan transactions.

- All payments flow in and out through this account, not directly between lender and borrower.

How Does the Escrow Payment Process Work?

To understand how your money is protected, let’s break it down into steps:

- Registration and Profile Setup: Both parties sign up, complete their verification, and agree to the platform rules. Everyone is KYC-verified, so anonymous transactions aren’t allowed.

- Funding the Escrow Account: Lenders deposit money into a special escrow account, managed by a registered trustee.

- Matching and Loan Disbursement: When a loan gets matched:

- The platform sends instructions to the trustee.

- The trustee checks all documents.

- Only then does the escrow bank release the funds from the lender’s escrow account to the borrower’s bank account.

No platform official or employee can directly withdraw or divert these funds for anything else.

- Receiving Repayments: As repayments come back from the borrower, they go straight into the escrow. After checks, the platform tells the trustee to release the money to the original lender’s bank account.

Why Does the Escrow Mechanism Matter?

Simple answer: Security and trust.

The escrow system builds a strong separation between your money and any possible misuse. The platform can see the flow (“view-only access”) but can’t touch the funds.

- No intermingling: Money never touches the platform’s balance sheet.

- Limited exposure: Funds stay less than a day (NBFC-P2P T+1 rule), meaning quick turnaround but little risk of long delays.

- Audited system: The bank does Regular checks, and trustees keep things above board.

What Does the RBI Say?

Regulators in India, especially the RBI, have made strict rules:

- Two different escrow accounts on every platform: one for incoming lender funds and one for borrower repayments.

- Only registered NBFC-P2P businesses can touch this process, and they must have a trustee to operate the account.

- No cash is allowed—just bank transfers are allowed for full traceability.

- Funds must move out of escrow within one business day. No parking of funds—fast and accountable.

This setup nearly erases the risk of money being misused or held longer than needed.

What are the Benefits of the Escrow Mechanism for Lenders and Borrowers?

What Makes the Escrow System a Big Win for All?

- Transparency: You always know where your money is in the process. Nothing is hidden or delayed thanks to mandatory disclosures.

- No misuse: The platform can’t use your balance for its own needs—not for lending to others, not for platform expenses, nothing.

- Fast processing: Disbursals and repayments move quickly.

- Dispute redressal: If a problem pops up, the trustee acts as a neutral, regulated party with strict logs and audit trails.

- Platform independence: Even if the platform itself has issues, your funds in escrow are protected and unaffected till the formal instruction.

What About Problems or Fraud?

No system is perfect, but the combination of strict controls, regular audits, and neutral trustees means:

- No single party can move money without approval.

- Detailed logs create a solid paper trail for every rupee.

- Complaint mechanisms kick in if something looks off—the trustee and the banks have legal obligations to intervene fast.

Simple Example: How the Escrow Works

Let’s say:

- You’re lending ₹5,000 to a borrower.

- You put ₹5,000 in escrow (managed by ICICI Trusteeship or another approved trustee).

- The borrower’s request is matched, documents are cleared.

- Trustee gets the go-ahead and releases your funds directly into the borrower’s bank account.

- Borrower repays monthly—the EMI goes right back into the escrow, then gets routed into your bank account.

During the whole process:

- The P2P platform never holds your funds as “their own.”

- All movement is tracked, transparent, and usually done within just one banking day.

Conclusion

The escrow mechanism builds more trust in P2P lending. It’s the reason more people are willing to lend or borrow on these platforms.

The next time you use a platform like this, you can feel confident that your money never gets lost in the system. It’s protected, clearly tracked, and only moves exactly where it needs to—giving both lenders and borrowers the confidence to take part in P2P lending.