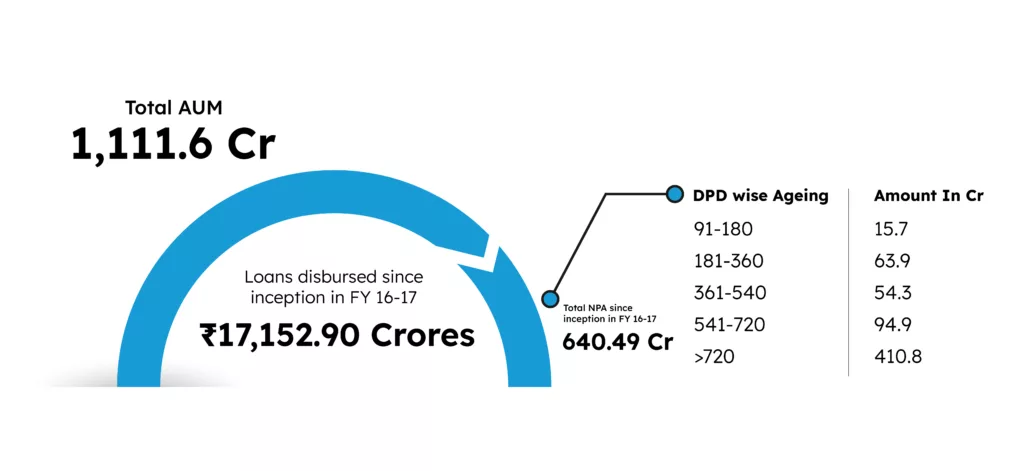

The AUM (Assets Under Management) figure represents the total outstanding principal of all loans disbursed through the platform. It is calculated using the following formula:

AUM = Principal of Total Loans Disbursed – Principal of Total Loans Repaid.

This gives the current principal balance remaining from all disbursed loans and does not include closed loans which were not NPA.

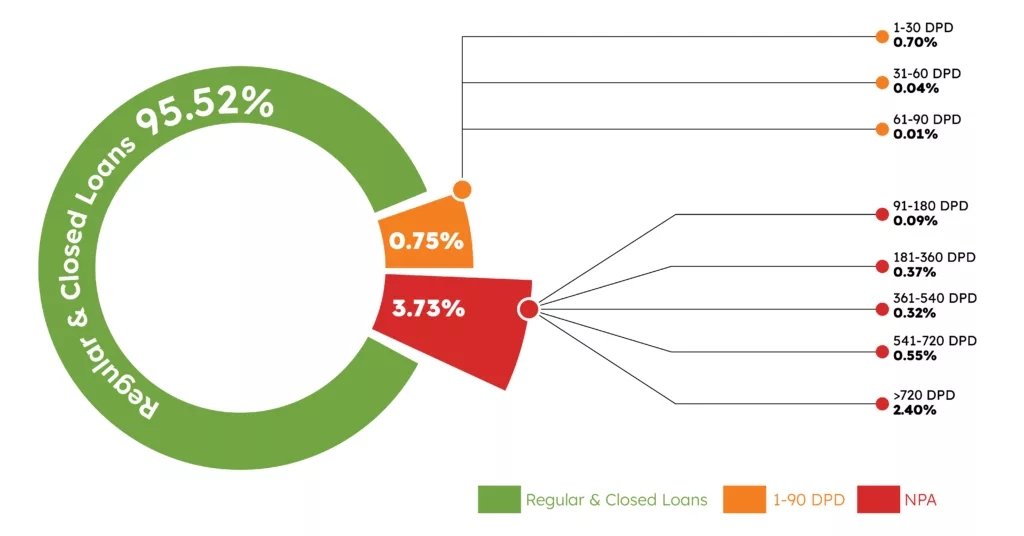

Performance breakup of total loans lent

*Portfolio performance updated as on 30th September 2025

*DPD – Days past due

*NPA – Account is classified as NPA if the loan remains overdue for more than 90 days

Impact of NPA on Interest and / or Principal Loss

The lenders on the platform have used the interest they earned to issue additional loans. The below table illustrates how non-performing assets (NPAs) impact both the original principal lent and the interest earned, which is subsequently used for further lending by the lenders. The loss of interest doesn’t mean loss of returns. This table shows that NPA impact is being absorbed by gross interest from borrowers and return of lenders remain intact.

| DPD Wise Ageing | Loss of Principal (in Cr) | Loss of Interest (in Cr) |

|---|---|---|

| 91-180 | 0.00 | 15.7 |

| 181-360 | 0.00 | 63.9 |

| 361-540 | 0.00 | 54.3 |

| 541-720 | 0.00 | 94.9 |

| >720 | 23.1 | 410.8 |

| Total | 662.6 | |

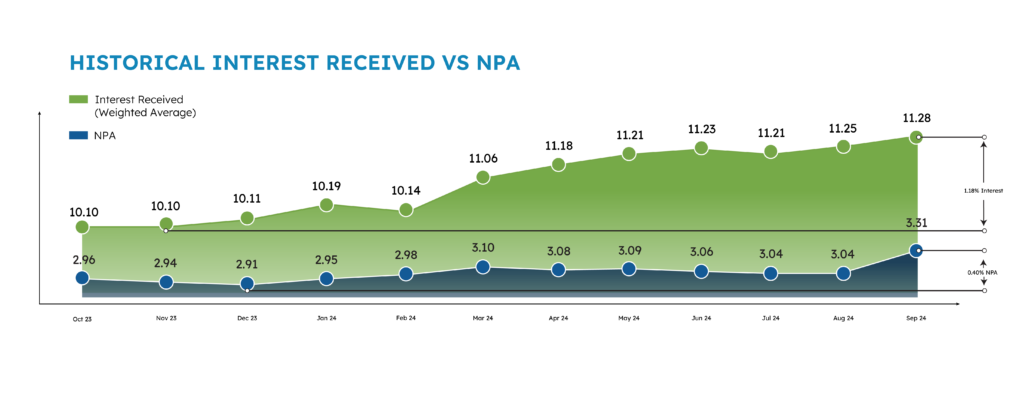

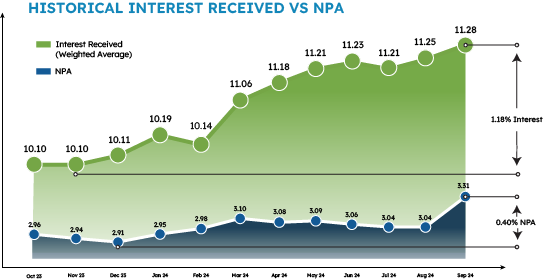

Historical Interest Received VS NPA

Lenders on LenDenClub platform benefit from strong interest earnings. Below is the illustration of returns earned over the past 1 year against the monthly delinquency of loans exceeding 90+ DPD at the portfolio level.

Below is the historical data of returns earned over the past 1 year against the monthly NPA of loans at the portfolio level.

Platform Performance: NPA Percentage of Disbursed Loans

Cumulative loan amount disbursed (Amount in Crores)

Number of cumulative Registered lenders – 2.4 million

Performance Report

P2P Lending is growing rapidly in India. Question is, how and who is contributing to this growth.

Here we present to you a summary of how the lenders of LenDenClub have been earning attractive interest by lending as low as ₹ 10,000 to as much as ₹ 50 Lacs.

Download the Fact Sheet to learn more about these stats and more.

We don’t just say, we achieve results!

FMPP® Quarterly Performance

In the last quarter, FMPP® lenders have earned upto 12% p.a. since launch

You can make the best use of your funds by lending in FMPP®.